Риск-менеджмент Залог Успешной Торговли На Форекс

March 12, 2022Dollar debt in FX swaps and forwards: huge, missing and growing

March 25, 2022

A high DSO can indicate slow collections, potentially straining resources. Conversely, a low one suggests that customers are paying quickly, enhancing cashflow. By effectively managing this metric, the SMB can optimize its cashflow, ensuring it has sufficient liquidity to cover other expenses or invest in new projects. However, an imbalanced number can harm supplier relationships or result in missed early payment discounts. Juggling suppliers, cashflow, and growth can be challenging for SMB owners.

Cash Paid to Suppliers for Inventory

İçindekiler

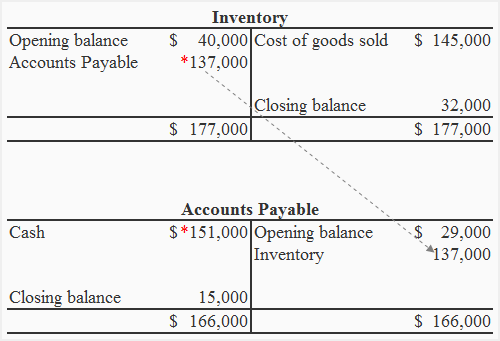

The direct approach requires that each item of incomeand expense be converted from the accrual basis value to the cashbasis value for that item. This is accomplished by adjusting theaccrual amount for the revenue or expense by any related currentoperating asset or liability. Revenue and expense items that arenot related to those current asset and liability accounts would notneed an adjustment. The cash paid to suppliers for purchases relating to inventory is calculated by adjusting cost of goods sold (COGS) from the income statement for movements in inventory and accounts payable (AP) from the balance sheet. The amount of cash received from customers is calculated by adjusting total sales shown in the income statement for the movement in the customer accounts receivable balances (AR) shown in the balance sheet.

Steps in Preparing Cash Flow from Operating Activities

Cash flows are either receipts (ie cash inflows and so are represented as a positive number in a statement of cash flows) or payments (ie cash out flows and so are represented as a negative number using brackets in a statement of cash flows). The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. Therefore, when calculating cash flow from operating activities, loss on sale of fixed assets should be added back and profit on sale of fixed assets should be deducted from net profit. Given that it is only a book entry, depreciation does not cause any cash movement and, hence, it should be added back to net profit when calculating cash flow from operating activities. Operating activities are the transactions that enter into the calculation of net income.

- With Stenn’s revenue-based financing options, you can seamlessly bridge cashflow gaps and accelerate your business growth.

- With the passing of strict rules and regulations on how overly creative a company can be with its accounting practices, chronic earnings manipulation can easily be spotted, especially with the use of OCF.

- Both are critical financial metrics that provide insights into a company’s cashflow management, but they measure different aspects.

- Under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company’s income statement.

- The receipts from customers equals net sales for the period plus the beginning accounts receivable less the ending accounts receivable.

Ask Any Financial Question

The receipts and payments information calculated using the cash flow direct method formulas shown above are used to construct the direct method cash flow statement in a format similar to that shown below. The cash paid in respect of expenses is calculated by adjusting total expenses from the income statement for movements in prepaid expenses and accrued expenses from the balance sheet. Since it is prepared on an accrual basis, the noncash expenses recorded on the income statement, such as depreciation and amortization, are added back to the net income. In addition, any changes in balance sheet accounts are also added to or subtracted from the net income to account for the overall cash flow.

Computing cash flows

The indirect method for calculating cash flow from operations uses accrual accounting information, and it always begins with the net income from the income statement. The net income is then adjusted for changes in the asset and liability accounts on the balance sheet by a cost which changes in proportion to changes in volume of activity is called adding to or subtracting from net income to derive the cash flow from operations. To prepare the operating activities section of the direct method cash flow statement we consider each line of the accruals based income statement in turn and convert it to a cash basis.

Direct Method Cash Flow Formula

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

The offset to the $500 of revenue would appear in the accounts receivable line item on the balance sheet. On the cash flow statement, there would need to be a reduction from net income in the amount of the $500 increase to accounts receivable due to this sale. It would be displayed on the cash flow statement as “Increase in Accounts Receivable -$500.” Cash paid for insurance is different from the insurance expensethat is recorded on the accrual basis financial statements.

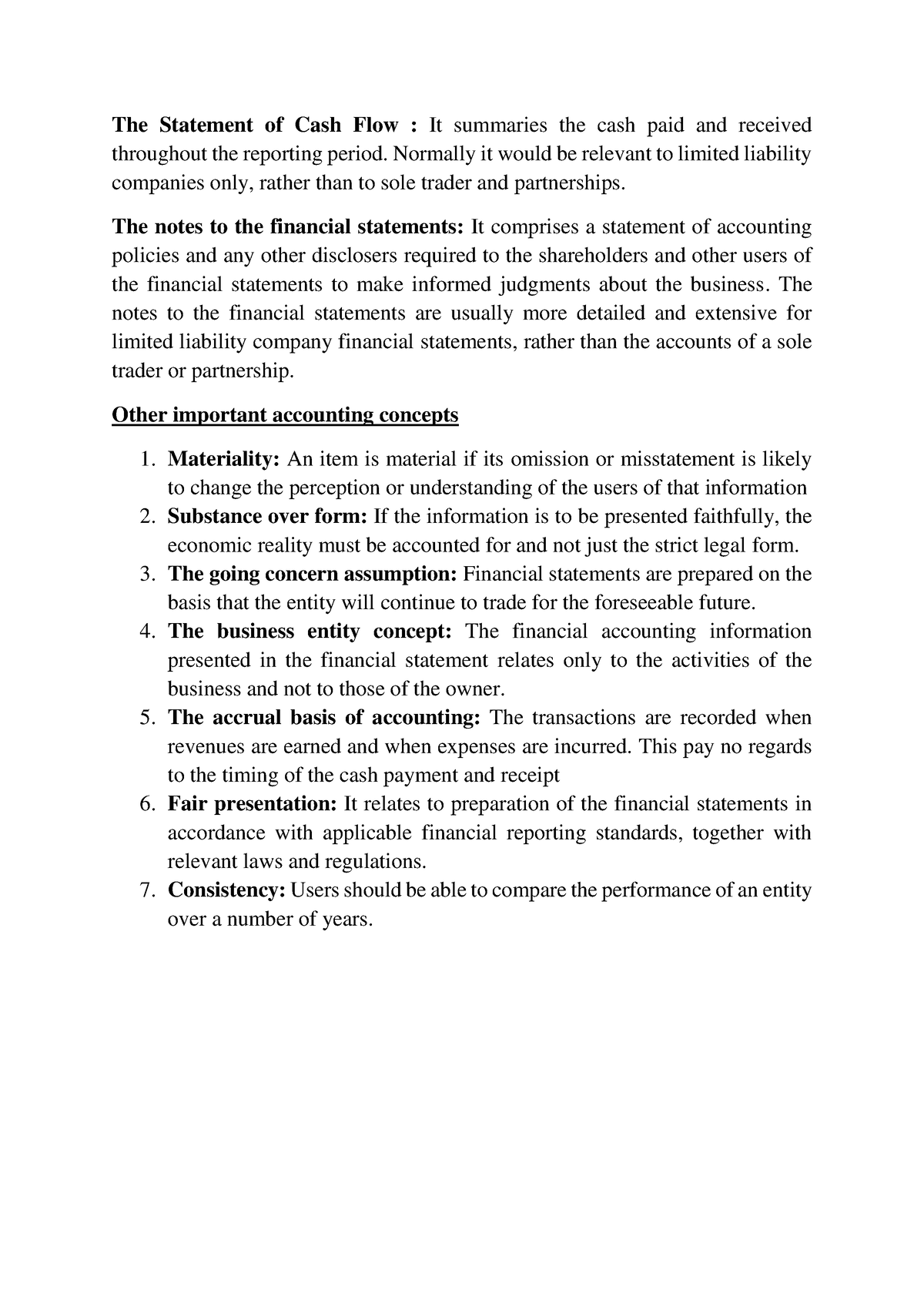

Cash paid for inventory is different from the cost of goods soldthat is recorded on the accrual basis financial statements. Toreconcile the amount of cost of goods sold reported on the incomestatement to the cash paid for inventory, it is necessary toperform two calculations. The first part of the calculationdetermines how much inventory was purchased, and the second part ofthe calculation determines how much of those purchases were paidfor during the current period.

The changes in inventory, trade receivables and trade payables (working capital) do not impact on the measurement profit but these changes will have impacted on cash and so further adjustments are made. For example, an increase in the levels of inventory and receivables will have not impacted on profit before tax but will have had an adverse impact on the cash flow of the business. Thus, in the reconciliation process, the increases in inventory and trade receivables are deducted from profit before tax. Conversely, decreases in inventory and trade receivables are added back to the profit before tax.

Cash flows are either receipts (ie cash inflows) and so are represented as a positive number in a statement of cash flows, or payments (ie cash outflows) and so are represented as a negative number in a statement of cash flows. The first option is the indirect method, where the company begins with net income on an accrual accounting basis and works backwards to achieve a cash basis figure for the period. Under the accrual method of accounting, revenue is recognized when earned, not necessarily when cash is received. To calculate payment to suppliers, we first need to calculate inventories purchased which equal closing inventories balance plus cost of sales (net of any depreciation and amortization) minus opening inventories balance. Next, we need to find payments to suppliers which equal inventories purchased plus opening accounts payable minus closing accounts payable. In our example above, total payment to suppliers work out to $192 million.