Alcoholic Nose: Signs, Causes & Treatments

December 3, 2020Atlético Madrid FC Barcelona Rezumat: Fotbal Scoruri & Rezumate

February 22, 2021

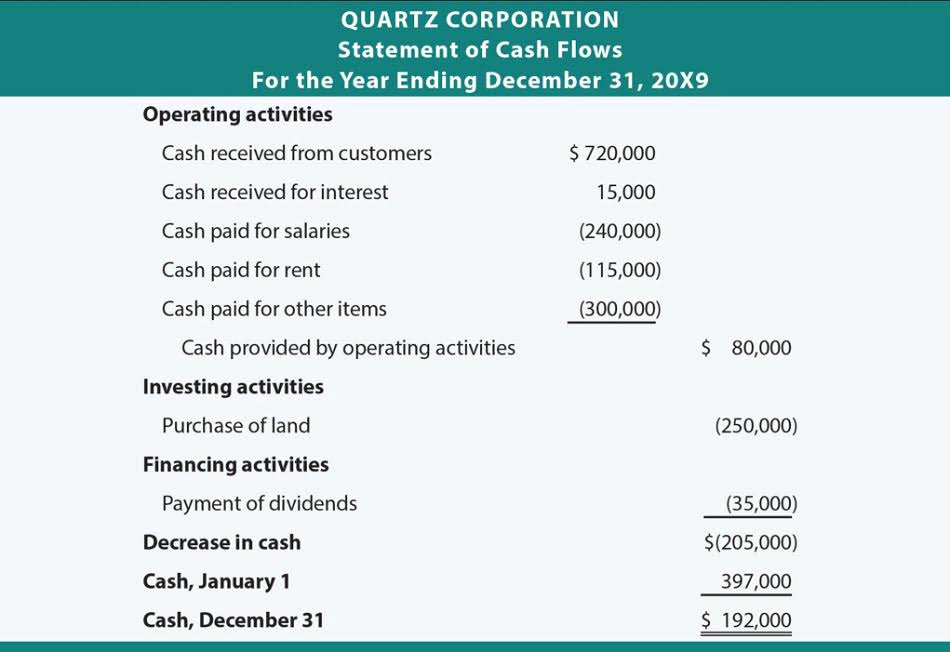

The income statement reflects the periodic allocation of amortized expenses, providing insights into profitability and operating performance. Meanwhile, after considering amortization, the balance sheet showcases the adjusted values of long-term assets and liabilities. amortization refers to the allocation of the cost of Amortization ensures that expenses related to long-term assets, like buildings or equipment, are spread out over their useful life. By allocating these costs over time, businesses can better align their expenses with the revenues generated by these assets.

Depreciation recapture in the partnership context – The Tax Adviser

İçindekiler

Depreciation recapture in the partnership context.

Posted: Mon, 01 Aug 2022 07:00:00 GMT [source]

Deducting capital expenses over an assets useful life is an example of amortization, which measures the use of an intangible assets value, such as copyright, patent, or goodwill. One of the trickiest parts of using this accounting technique for a business’s assets is the estimation of the intangible’s service life. Business operators must weigh out the economic value to the company, including the book value, residual value, and the useful life of the intangible asset. Depletion expense is commonly used by miners, loggers, oil and gas drillers, and other companies engaged in natural resource extraction. Enterprises with an economic interest in mineral property or standing timber may recognize depletion expenses against those assets as they are used.

Pros and Cons of Loan Amortization

For example, an oil well has a finite life before all of the oil is pumped out. Therefore, the oil well’s setup costs can be spread out over the predicted life of the well. Amortization schedules can be customized based on your loan and your personal circumstances. With more sophisticated amortization calculators you can compare how making accelerated payments can accelerate your amortization.

Understanding how this principle works will enable you to navigate these areas more effectively, whether you are involved in accounting, investments, or loans. The depreciation class includes an asset account which appears as an asset in the balance sheet, and therefore it maintains a positive balance. This depreciation class is under assets subject to depreciation, and it shows in the balance sheet as the net depreciable asset together with the depreciation sum account.

What is Depreciation, Depletion, and Amortization?

This knowledge empowers them to make informed decisions regarding investments and resource allocation. After capitalizing natural resource extraction costs, you can easily allocate the expenses across different periods based on the extracted resource. Until that time, when the expense recognition takes place, these costs are usually held on the balance sheet. The useful life of the patent for accounting purposes is deemed to be 5 years.

The goodwill impairment test is an annual test performed to weed out worthless goodwill. A business client develops a product it intends to sell and purchases a patent for the invention for $100,000. On the client’s income statement, it records an asset of $100,000 for the patent. Once the patent reaches the end of its useful life, it has a residual value of $0.

Tax and accounting regions

Some common methods are the straight-line method, the fixed-rate method, the effective interest rate method, and the bullet and balloon methods. In regards to debt, it is a way to track future expenditures and create a method of repayment. Loan amortisation is paying off the debt of something over a specified period. At the end of the amortised period, the borrower will own the asset outright.

- Many must create a repayment plan to pay off their mortgages, which is covered below.

- The change significantly boosted economic growth over the last 50 years and made the economy nearly $560 billion larger than previously estimated.

- AOL paid $162 billion for Time Warner, but AOL’s value plummeted in subsequent years, and the company took a goodwill impairment charge of $99 billion.

- A single line providing the dollar amount of charges for the accounting period appears on the income statement.

- Expensing off asset balances is most useful for a company that deducts the expense from its taxable income.

- Intangible means without physical existence, in contrast to buildings, vehicles, and computers.

- Depreciation, on the other hand, would have a credit placed in the contra asset accumulated depreciation.

An intangible asset refers to things that cannot be physically touched but are real nonetheless. Depreciation applies to expenses incurred for the purchase of assets with useful lives greater than one year. A percentage of the purchase price is deducted over the course of the asset’s useful life. Of the different options mentioned above, a company often has the option of accelerating depreciation.

What is Amortization in Simple Terms?

Depreciable property is otherwise known as a depreciable asset, this is an asset that can be depreciated following the Internal Revenue Service (IRS) rules. When depreciated, the value of the asset is regarded as business expenses over its useful life, this is deducted from the tax return of the business. With the QuickBooks expense tracker, small businesses can organize and keep tabs on their finances, including loans and payments! There are easy to use schedule calculators that can help you figure out the best loan repayments schedule, taking into account the interest rates and loan type and terms. Loan amortization is paying off the debt of something over a specified period. A business that uses this option is building equity in the loaned asset while paying off the item at the same time.